Subscribed by Tien Tzuo

A primer on the modern subscription model and its new prevalence across industries

Why should you read this? – To learn how recurring revenue models work, the shift from product to services, and hear about examples in any industry.

A lot has changed from 2018 to 2024. Subscriptions are commonplace and Wall Street deeply the model well. Cloud is ubiquitous. AI is available within our everyday services and products, spearheaded now by OAI. We’re unsure about which business models will prevail. We know that subscription fatigue is a real thing, both for consumers and enterprises.

While the book has a decent amount of fluff and is filled with lots of hit-and-miss predictions, I think it was worth a one-time read-through to cement the idea of the “product” to “service” mindset that’s taken place over the course of my lifetime. If you decide to read it, I’d skip straight ahead to Chapter 13 (Finance: The New Business Model Architects) and then 2x speed the other sections. Perhaps pause to think about the technical intuition for recurring revenue in the given industry.

Outline:

Chapter 1: The End of an Era

Digital transformation: from linear transactional channels to a dynamic relationship with your subscriber

Shift from a product-centric to a customer-centric organizational mindset describes subscription companies that see the traditional economy as a “service” up for grabs

Companies that survive follow their customer — they do not expect their customer to follow them

I’ll refute this on the grounds of having different types of moats (regulatory, natural, etc.)

Subscriptions have been around for a while; however, internet distribution via the cloud has enabled the shift (from CapEx to OpEx spending)

People prefer access and experience over ownership

Chapter 2: Flipping The Retail Script

Traditional big box retail straddled with debt by PE filed for bankruptcy

Digitally native companies have IRL spending, creating differentiated value in physical stores. Brick and mortar is far from dead, but there is a transition in which businesses

Unclear billing practices, difficult cancellation processes, and poor communication are negative option models. This leads to poor customer satisfaction scores and low NPS

Customers start their journey digitally and then move to in-person store

Chapter 3: The New Golden Age of Media

History: Blockbusters could reliably count on revenues; movie studios produced movies weekly with an 80/20 model. Then TV —> harder for movie theaters. Studios transitioned to making bigger and better hits, then selling merch/ads (monetizing the long tail). The internet then allowed for digital streaming. The media industry went ape sh*t. Apple saved music by offering $0.99 to buy your favorite song. It kept the old way so the Media industry agreed. Perpetuated the old way of only promoting Top 40 songs.

Platforms like Spotify and Netflix navigated the complexity of digital rights and created an important discovery layer

Netflix — subscription video on demand (SVOD)

The platform invests a sizable % of revenue back into sharp new content. While it doesn’t directly make it money, it creates new subscribers and extends the lifespan of current customers (lower CAC and retention)

The more niche you are, the more you have to differentiate. CrunchyRoll does that through the community.

Broadband is a cable cutter. Cable companies have the opportunity to become the OS of connected home

How do we make them feel more like members and less like customers?

Chapter 4: Planes, Trains, and Automobiles

Car industry subscription services model.

Pay-to-play for driver assist and luxury features: seat heating, self-driving, remote start & lock, etc.

Gives customers the feeling that the company is milking them. Doesn’t inspired brand loyalty

A lease binds you to a specific vehicle. A subscription lets you flip between vehicles. Signing up with the company. not the car. Registration, maintenance, insurance go away. With subscriptions, you also don’t have the option to buy which aligns the car company to keep vehicles in great shape

As lithium batteries replace combustion engine, hardware becomes commodified and info services becomes value driver

Just as IBM lost the user experience to Microsoft, car manufacturers are losing dashboard intelligence to Google, Apple, and Meta

The authors said they’d bet on Detroit over Silicon Valley in the car race, mostly due to economies of scale and regulations from the place of dealerships. Took PR notes from execs about autonomous cars being quarters not years away.

They were dead wrong

Commercial carriers lack predictable revenue and this struggle to scale operations effectively. Rely on tacky add-ons and surge prices. Airports benefit the retail industry but not consumer

Frontier pass has it

Passengers demand anytime anywhere travel. Incumbents can react nimbly — Salesforce CRM, Zuoro for subscription services, Okta for KYC, slim pay for payments,

SNCF example

Chapter 5: Companies Formerly Known as Newspaper

Real value is in quality content, not format (print vs digital)

Paid subscriptions for services > ad-based models

(1) People don’t like it (evidence: ad-block)

(2) Digital ads don’t make much sense from a business perspective

(3) Ads create clickbait factories —> race to the bottom

High correlation between people who are WTP for streaming and for other online content bc it gives them “subscription literacy”

Moving away from metrics like slideshow clicks to time spent on site

Direct relationship with customers makes ads a secondary but still vital revenue source

Transforming newspapers: goal is to drive legitimate reader engagement with a core audience rather than reverse engineering an editorial product

Financial Times dropped paywall on weekend of Brexit news and offered tailored subscriptions. Aggressively dialed up marketing on real-time basis while checking that it didn’t conflict with audience engagement

Metrics from FT

Recency: when did they last visit

Frequency: how often do they visit

Volume: how many articles have they read

Low scores indicate churn risks

Most of your profits are going to come from a core user base

Freemium model: offer a portion of your service for free to grow user base, then incentivize them with an enhanced paid plan

NYT has been circumspect about engaging in content-sharing agreements where Facebook, Google, or Apple kept the payment and demographic data (which is giving away the store)

Chapter 6: Swallowing The Fish: Lessons From The Rebirth of Tech

Software and data activities were becoming costs of doing business that must be paid by all but provide distinction to none

However, SaaS solutions started displacing a traditional Oracle one size fits all model

Adobe is the textbook case of incumbent switching from licenses to software model

IT buyers prefer OpEx to CapEx. OpEx has a pay as you go model (little upfront expenses), which frees up cash to drive growth

Software companies don’t adhere to a strict GAAP based valuation model. Deferred revenue means quarterly GAAP metrics take a hit

CISCO: would you be more interested in laying the tracks or delivering the freight

Focused on the data inside the hardware (routers and switches)

Makes hardware more affordable and operationalizes the software

Chapter 7: IOT and the Fall and Rise of Manufacturing

Komatsu: how many trucks can I sell you to how much dirt do you need moved?

Zuoro is powering dirt-removal as a service

Believes manufacturing stands to gain the most of any sector from switch to services

IOT - using sensors and connectivity to digitize the physical world

Remote monitoring; preventative maintenance; service provisioning and billing; forecast and plan revenue

Digital twins: display how physical assets are operating in real-time

Engineers on the ground use augmented reality headsets to see the parts next to their information specs

Consumer internet, then Enterprise internet, now the Industrial internet

Sensor retrofitting and networking are the implementation phase of IoT

Service-level agreements are replacing bills of sale. Start with the end outcome, and work backwards. IOT enables you to view your products as whole systems rather than individual parts

Healthcare pushed to remote monitoring rather than periodic testing

“Connectivity turns products into services, which enables businesses to build around outcomes, not assets.”

Having multiple beneficiaries as customers gives you more flexibility in pricing and selling. No straightforward B2B or B2C market approach

Sweden thermostat / energy arbitrage company works with all parties

AI: distributed and ubiquitous, just like any other common utility (like electricity)

Chapter 8: The End of Ownership

Healthcare, government, education, pet care, utilities

Tzuo seems to be overstating the subscription economy

Chapter 9: The WTF Moment

Video games

Update the game instead of quickly gaining revenue from new releases.

How to align all the different internal stakeholders in a company

Chapter 10: Innovation: Staying in BETA forever

Living breathing experiences rather than static products

Chapter 11: Marketing: Rethinking The Four P’s

Product (value prop, price (make sense for company and customer), promotion (advertise in attractive channels by attractive people), place (sell in convenient and compelling location)

When product turns to service…

Place: teach your distributors how to upsell subscriptions. 3 months on each: adoption, usage, renewal

Promotion: storytelling, multiple channels (social > search),

Story of your product (how), market (who), and overarching broader narrative (why)

Pricing and packaging

Ways to mess it up

Freemium and lack of conversion years later

Too much complexity in pricing charts

Flat monthly fee but people enjoy your service too much

Tie pricing to a metric your customers can’t value ahead of time

Consumption driven growth

Pick the right unit which ties consumption to value

Keep in mind: keep it simple for user, translate increased usage into revenue, have a usage floor (monitoring the consumption curve)

Unit price: price per unit or in usage tiers

Holes in your model, usually at extremes

Minimum or base floor

Capability driven growth

Add more features as growth expands

avoid too many a la carte models

If you have >70% of your subscribers in your basic package, then you may have a perfectly respectable entry level service that will ultimately kill you. You haven’t built a growth path.

Tiers may help you

Chapter 12: Sales: The Eight New Growth Strategies

(1) What are the broader implications for my job and my business if I go with you?

(2) What are other people out there doing?

Acquire more customs etc, increase the value of those customers, and hold on to customers longer

(1) Zuoro had diversity in the first set of customers, which set the tone of the business, but they erred still the right fit

(2) Don’t ramp up a big sales force. Have them stay very close to your first cohort rather than getting a quick commission

(3) Reduce your churn rate. Marks adolescent to mature business.

Subscription equilibrium… is the rate of growth > rate of loss

A flat or sinking rate is an all-hands-on-deck moment

Ask if: Are there customers I have to fire? Are there customers I should not be pursuing? What are the real features and usage patterns that equate to customers finding value? Do they need a little push — can your service be designed or packaged in a different way?

(4) Hybrid sales model + Invest in automation

Hybrid sales model

Self-service for basic features and sales support for advanced solutions

Self-service becomes lead generation

The sales team needs real-time info on customer subscriptions, billings, and refunds. Ability to calculate pro-rations when a customer upgrade to a different edition, expand a subscription, add more seats, or makes other changes

(5) Upsell (premium version of the same product) and cross-sell (complimentary item)

Customer success. The real work should start after the sale

Critical to customer retention

(7) Launch into a new segment

CLEAR started with business sellers, then families, then corporates

SMB vs Enterprise

BOX / Slack - Make your service as easy as possible to adopt across an entire company

(8) Go international. Barriers are usually language, not geography

Less so now with GDPR and other data laws

(9) Acquisitions with integration plan

Increase market visibility and market while enhancing offerings

SurveyMonkey used strategic acquisitions. 6 companies. Now cross-sells a number of services

(10) Optimize pricing and packaging

Chapter 13: Finance: The New Business Model Architects

Double entry bookkeeping. Debits = credits. Assets + liabilities = Equity

The income statement shows 4 fundamental costs in the unit (fixed and variable COGS and SG&A)

Does not differentiate between recurring and non-recurring dollars

S&M is matched to past goods sold — essentially a sunk cost

All about money already earned. Subscription is all about a forward-going basis

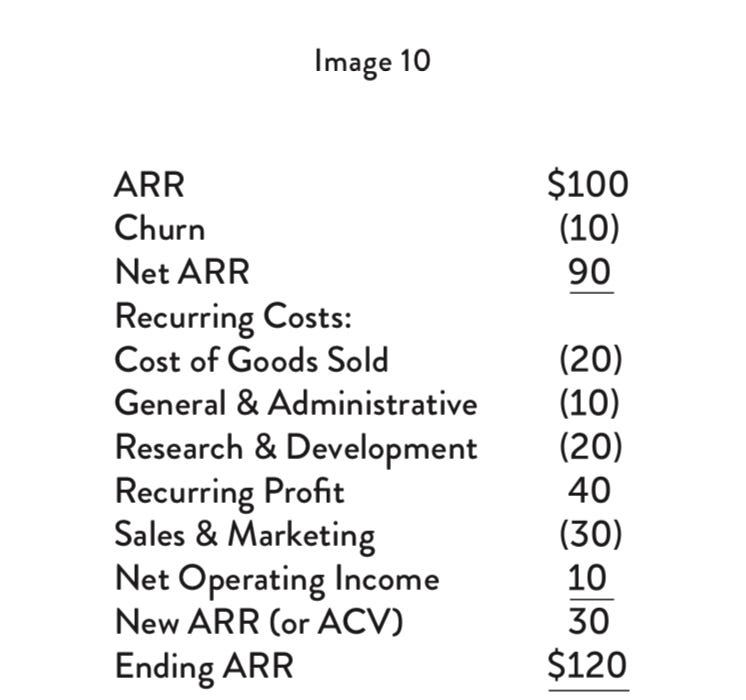

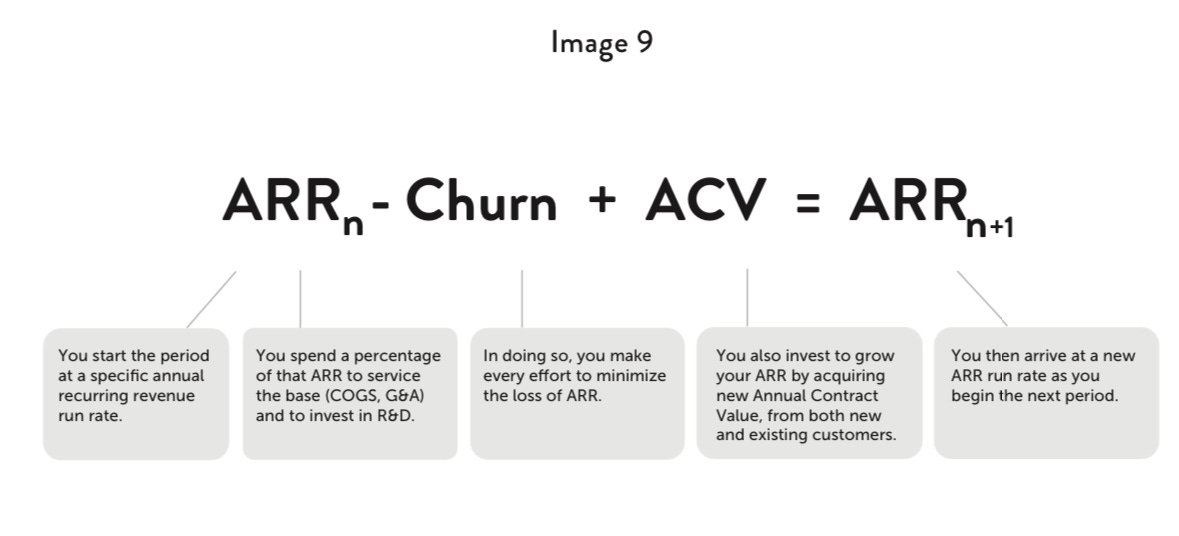

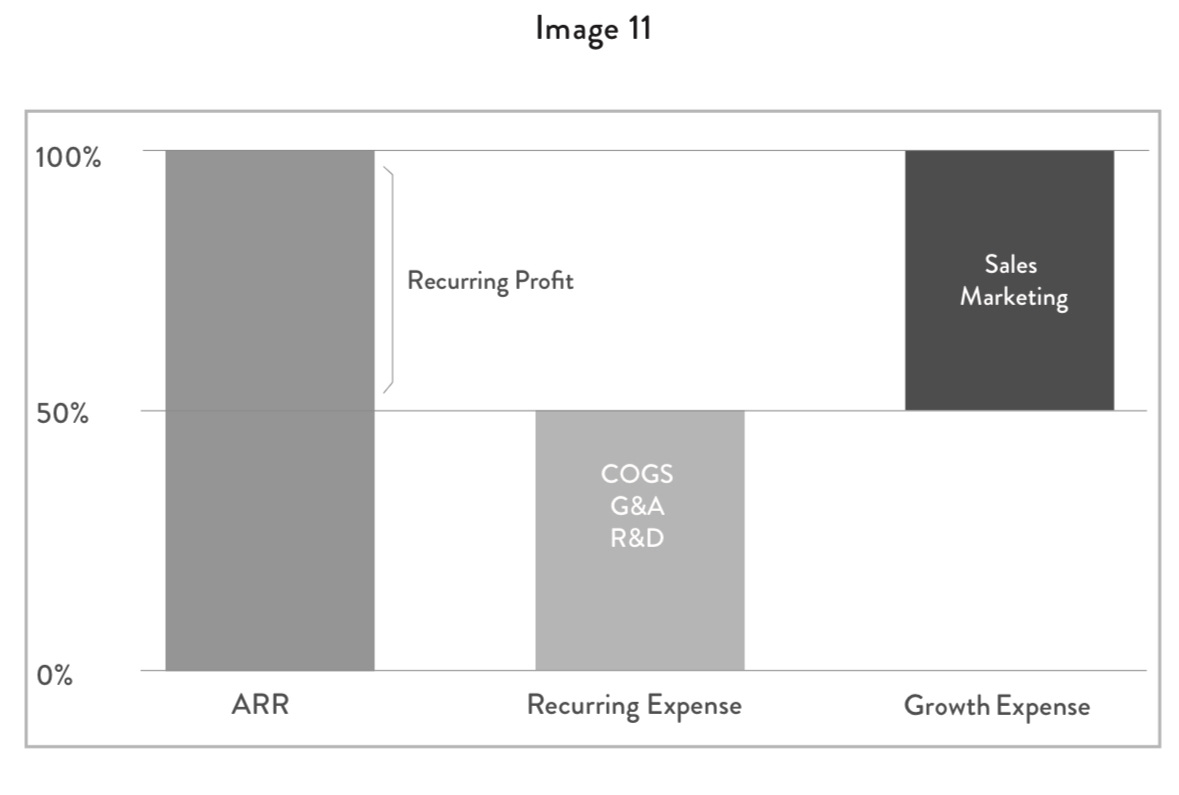

Subscription economy income statement

ARR

Start and end with ARR, not traditional revenue

You’re starting the quarter with $X in revenue

Churn

Reduction of ARR, regardless of the reason

Net ARR = ARR - churn

Recurring costs

COGS, R&D, and G&A are above the line, as a % of ARR

When ARR grows, your budget grows.

It makes it easy to benchmark against other public companies

Recurring profit = net ARR - recurring costs

Intrinsic profitability of your business

Tells you how strong it truly is

Sales & Marketing

Growth costs to get future ARR

It comes out of recurring profit until it maxes out. You can go above if you believe your retention and market size is phenomenal

General catalyst CLV fund model

It acts more like CapEx than OpEx

Simplifies by assuming 100% of S&M is used to grow

Net operating income = Recurring profit - S&M

Ending ARR = new ARR + old ARR

Many subscription companies appear unprofitable because GAAP isn’t forward-looking

It is perfectly rational to spend all profits on growth as long as your bucket doesn’t leak (ARR > recurring costs)

Try to keep recurring expenses flat and tilt spending to growth expenses. “If you can stay lean for 3 quarters, the dividends we generate from our business model will be worth it.”

Growth efficiency index (GEI): When you spend $1 on S&M, how many new ARR dollars does that buy you?

Efficient means GEI <1. Step on the gas pedal

How does Netflix know it can spend $8B in content next year? Because it knows its recurring profit and will use the remaining margin to do as it pleases.

Chapter 14: IT: Subscribers, Not SKUs

AB testing is only useful if the turnaround time is quick

Data lives in different software siloes… the finance and sales teams can give wildly different MRR numbers

Bookings — CRM

Billings & Cash flow — ERP or general ledger

Revenue — complex spreadsheets

The nature of ERP systems is to track products on palettes, not for services over time. Any color as long as it’s black.

CRM was like Salesforce or Microsoft

Quoting, fulfilling, and ordering systems are daisy-chained together in a strictly linear format

50 widgets. $10,000. The quote is carbon copied and then passed to the orders desk. The credit check is given an OK and then passed to the fulfillment desk. The warehouse fulfillment guy packs 50 widgets in a box and tapes it. Product cost, taxes, shipping costs, and applicable discounts and mails out an invoice. This flags the collections department, which charges the credit card. Finally, an accountant in the fulfillment department books the $10,000.

There are tons of these quote-to-cash-systems in big organizations, whether via acquisitions, value-added resellers that need their system, launching in a new country for specific protocols, or other internal processes

Change one thing, change everything

Subscribers are constantly renewing, suspending, upgrading, and downgrading their services

Legacy companies are forced to recode each system.

With subscriptions, you change the pricing and packaging of services — weekly to monthly or seats to usage.

It takes too long to figure out how to price new services if you have to recode a new system

Throw all your company in a data lake: take info from dozens of systems into an undifferentiated mess. A jigsaw puzzle can’t solve itself.

Put subscriber IDs into the center of your architecture.

Tien Tzuo did a great job of selling his service, Zuoro.

Chapter 15: Building A Subscription Culture with the Padre Operating Model

Organizational structure is the biggest thing holding us back

Recall the SCALE framework from Gad Allon

Who should do what siloed thinking instead of doing what was good for the customer?

Tried to organize teams dedicated to particular types of customers. Did not scale well or leverage shared expertise and common training

PADRE PPM — a bit of a fluffy business framework

Pipeline

Build market awareness. Translate that into demand. Who are you, why do you exist, and what benefit do you provide? Create an interested and well-informed base of subscribers

Acquire the subsystem

Buyers journey. What are their alternative solutions and potential objections? Who do they have to check in with?

Deploy

Get customers up and running as quickly as possible

Run

How well and how long your subscribers take advantage of your service

Expand

Retention, growth, and advocacy. Make sure it’s better than what they can get anywhere else.

3 core subsystems PPM: people, product, and money

Future reads on similiar topics:

Technology-As-a-Service Playbook: How to Grow a Profitable Subscription Business by J.B. Wood and Thomas E. Lah

Skim

The Engines That Move Markets by Alisdair Nairn (re: Sequoia piece on $200/600B AI gap)

Study

Under The Radar by Robert Young

Study to learn about the open-source movement